Writing from My Favorite Investors

Jacob Taylor’s Practice – Part 2

This is the third in a series of pieces written by guest investors reflecting on their practices. The second half of Jacob Taylor’s piece concludes with details about the process of choosing investments. To hear more from Jacob on his investment hygiene practice, check out this week’s Invested Podcast, on which he will be my guest.

Jacob Taylor is the CEO of Farnam Street Investments, a host of the popular show “Value: After Hours,” the host of the author interview series Five Good Questions, creator of the world’s first hikecast, and was an adjunct professor at UC Davis’s Graduate School of Management. Jake’s first literary effort, The Rebel Allocator, is a bestseller on Amazon. He lives in Folsom, California with his wife and two boys where he enjoys being the second best-selling author in the house.

Written by Jacob Taylor

Table of Contents

1. Calibration

2. External + Mental = Signal vs. Noise

3. Final, Most Important Takeaway

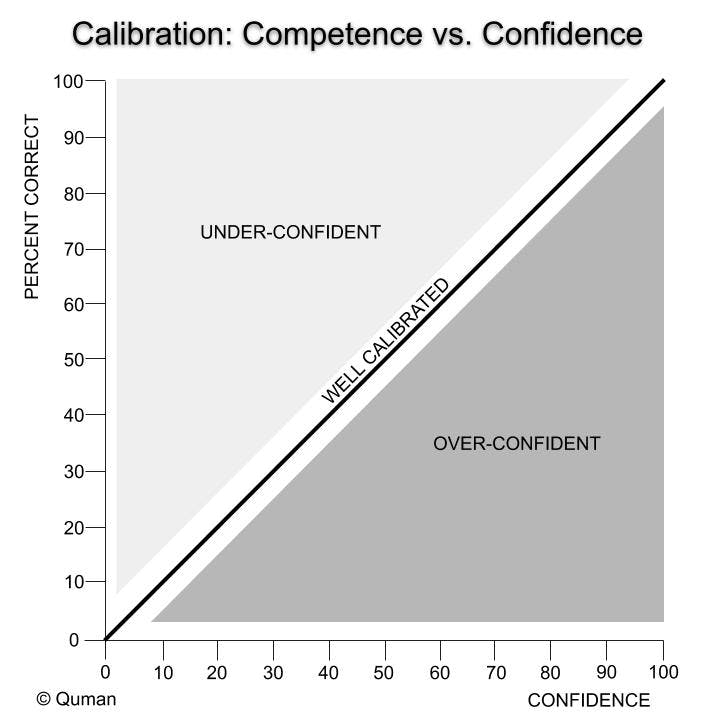

1. Calibration

Make and track probabilistic predictions and get calibrated.

If 2020 has taught us anything, it’s that markets can whipsaw our emotions more than the most mercurial of lovers. Do you remember the fear permeating March when the S&P 500 plunged more than 25%? How about the euphoria of August as we made new highs?

Chances are, we’re all misremembering key elements of the past. Human memory is based on story-telling. Our memories are only as reliable as the last version of the story we told ourselves. That was good enough to economize brain power and survive on the linear savannah. Yet our story-telling memories can be a liability in a complex world where the arrows between cause and effect are suspect.

When DNA testing was first introduced, Innocence Project researchers reported that 73 percent of the convictions overturned through DNA testing were based on eyewitness testimony. One third of those overturned cases rested on the testimony of two or more mistaken eyewitnesses. “I could have sworn I saw…”

The good news is we have a simple fix for our shoddy memories. Nobel prize winner Daniel Kahneman has the answer:

“Go down to a local drugstore and buy a very cheap notebook and start keeping track of your decisions. And the specific idea is whenever you’re making a consequential decision, something going in or out of the portfolio, just take a moment to think, write down what you expect to happen, why you expect it to happen and then actually, and this is optional, but probably a great idea, is write down how you feel about the situation, both physically and even emotionally. Just, how do you feel? I feel tired. I feel good, or this stock is really draining me. Whatever you think.

The key to doing this is that it prevents something called hindsight bias, which is no matter what happens in the world, we tend to look back on our decision-making process, and we tilt it in a way that looks more favorable to us, right? So we have a bias to explain what has happened.”

Keep an investment journal.

The investment world is full of the ones that got away. “Why didn’t I buy $AMZN at IPO?! And of course $GOOG was going to be a home run!” We could build a killer portfolio with all of our sins of omission.

“The main mistakes we’ve made, some of them big time, are ones when we didn’t invest at all, even when we understood it was cheap. We’re more likely to make mistakes of omission, not commission.” — Warren Buffett

Hold on a sec, though. Is it possible we’re fooling ourselves? Perhaps we’re only remembering the rocket ships to wealth that we didn’t climb aboard. There are probably just as many rockets we didn’t get on that exploded on the launchpad, but they don’t spring to mind as easily. Near misses are quickly forgotten.

We need a better system to track all of the investments we’ve rejected. Call it your “anti-portfolio. ”It measures the true opportunity cost of the investments we didn’t make. I suggest recording the ideas you said no to and periodically checking in on the whole basket. You’ll get the full picture, not just the acutely painful misses that stick out in your memory.

“I would argue that one filter that’s useful in investing is the simple idea of opportunity cost.” — Charlie Munger

Track your opportunity cost.

The real magic gets unlocked when you start coding the reason why you said “no” to a particular idea. This feedback will give you a sense of how your filters are impacting your investment process.

Warren Buffett famously has an inbox on his desk labeled “Too Hard Pile.” The box serves as a reminder to only search for obvious investment opportunities he readily understands. But especially when you’re just starting out, it’s difficult to figure out how hard is too hard. What if you find your Too Hard Pile of rejects is consistently shooting the lights out? That could be the nudge you need to put in a little more effort on ideas. Perhaps you’re giving up too early, and there’s investment gold waiting for you if you dug just a little deeper.

How else will you ever know if your rejection filters are poorly calibrated unless you keep score of what you discarded and why?

Calibrate your rejection filters.

I have an exercise I borrowed from Charlie Munger to help me from repeating mistakes. I call it a “Rub My Nose In It” session. Others call it a postmortem.

“I like people admitting they were complete stupid horses’ asses. I know I’ll perform better if I rub my nose in my mistakes. This is a wonderful trick to learn.” — Charlie Munger

Performing a serious study of your mistakes can help lessen the sting of an unsuccessful investment — at least you learn something. A postmortem is also a great way to evolve your checklist. It’s counterintuitive, but a mistake caught, documented, and processed can be more valuable than a success early on in your investment journey. Lose the battle to win the war.

It’s not well-known, but famed UCLA coach John Wooden was an early sports stats-geek. He kept meticulous notes on his players and spent considerable time pre-planning and post-examining his practices. He would follow up every practice with pages of notes: ”we need two more minutes on this drill, less on another.” Full post-mortems. He was maniacal about optimization, which allowed him to get better with more data over time. You can do the same with your investment process with a little thought.

Conduct postmortems and rub your nose in your mistakes.

2. External + Mental = Signal vs. Noise

“Investing is not a game where the guy with the 160 IQ beats the guy with a 130 IQ. Rationality is essential. What you need is emotional stability. You have to be able to think independently.”

— Warren Buffett

Markets are complex adaptive systems. There are millions of buyers and sellers, interpreting and acting on billions of data points any given year. You’d never try to guess the next move of an ant colony, the shifting of storm clouds, or the sudden break of a school of fish. And yet oceans of pointless ink are spilled predicting the market’s next move, and providing explanations for what just happened.

I’m giving you permission now to ignore all that noise. Put yourself on an information diet.

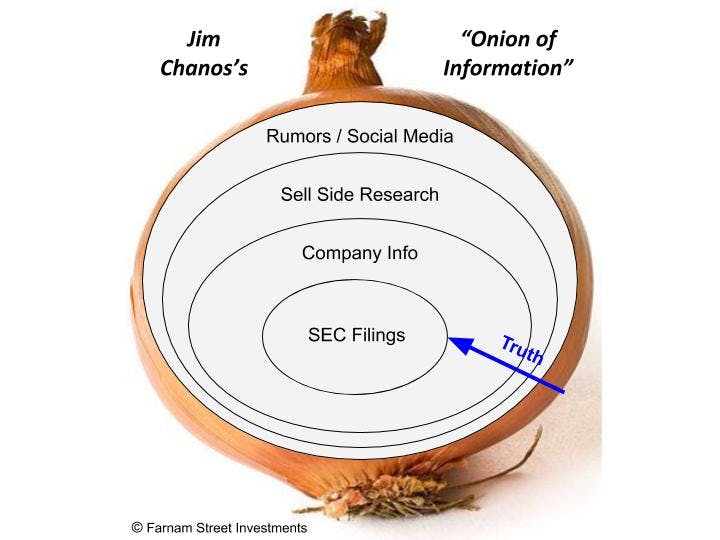

Famed short-seller Jim Chanos describes research as an information onion. The layers move from closest to the truth out toward the noisy outer shell:

SEC Filings – what the company has to tell you.

Company Information – slide decks and conference calls that represent what the company wants to tell you.

Sell Side Research – what others (often conflicted) want you to know.

Rumors / Social Media – what the crowd thinks.

Spend your valuable research time where the signal-to-noise ratio is the most favorable.

That means more 10Ks and less Twitter.

Go on an information diet.

Nassim Taleb has a thought experiment that really opened my eyes. Imagine an investment with a 15% return and 10% volatility. Over one year, you’d have a 93% chance of success. Could we all be so lucky! However, that same investment would only have a 54% chance of success on a given day, and a 50.17% of being up any given minute. It would effectively be a coin flip on whether you felt good or bad if you spent all day focused on minute-by-minute ticks of the tape.

We all share a cognitive bias called “loss aversion.” It means that losses hurt at about twice the magnitude as gains feel good. On a dollar-for-dollar basis, pain is twice that of pleasure. Back to our coin flip: if you were to check your stock price every minute, you would get roughly twice as much pain as joy. If you were to only look once per year, you’d have a 93% chance of feeling good.

Your psychological experience of ownership can be directly affected by how often you check the price. Warren Buffett has observed that stocks don’t care who owns them and that we should be willing to have the stock market close for ten years if we’re going to own something for more than ten minutes. No one is saying this is easy; ignoring the market for long periods can be incredibly difficult in practice. But hanging on every tick is a recipe for heartache, even if your long term outcome is favorable.

Don’t check your stock prices too often.

3. Final, Most Important Takeaway

“It’s waiting that helps you as an investor, and a lot of people just can’t stand to wait.”

— Charlie Munger

As we’ve detailed, the world of investing is particularly ripe for inducing brain damage. The environment is noisy, groupthink is common, overconfidence runs amok, and the stakes are high. Only sex, drugs, and rock’n’roll are more emotionally charged than money. The fear of missing out is strong and it goes against our human instincts to do something different than the crowd.

There’s one overarching goal to all this investment hygiene: bolster your patience.

From optimizing the chemicals in your brain, to taking walks, to the desk you sit at, to the investment journal you keep, to your information diet, it’s all about cultivating the advantage of patience.

“The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett

A deeper pool of patience is the biggest edge you have over professional managers, and you can extend that advantage through your investment hygiene.

Be patient.

Start tracking and improving your investment hygiene today.