Writing from My Favorite Investors

Jacob Taylor’s Practice

Happy Thanksgiving to all of us, Americans and non-Americans. I’m always grateful for the privilege of sharing my practice with you, but never more so than this year, when you’ve stuck with me through great challenges. Thank you. I’m still struggling with the long version of Covid and have good weeks and bad weeks, but when I’m feeling good I have incredible bursts of creativity focused on improving my investing practice. I can’t wait to share more with you. Two of the fun discoveries for me in the last few months, and a saving grace in all this crappiness, has been that my investing practice is still my absolute favorite thing to do and my portfolio has grown exponentially while I’ve been ill in bed. Nothing like a vocation that works while you sleep.

This is the second in a series of pieces written by guest investors reflecting on their practices. I’m thrilled to share this piece from Jacob Taylor with you today. His ideas are deeply thought out, well-practiced, and packed with so MUCH information that I have been ruminating on all the ways my practice will benefit. I recommend reading it a few times over a few days to let it sink in. Jacob Taylor is the CEO of Farnam Street Investments, a host of the popular show “Value: After Hours,” the host of the author interview series Five Good Questions, creator of the world’s first hikecast, and was an adjunct professor at UC Davis’s Graduate School of Management. Jake’s first literary effort, The Rebel Allocator, is a bestseller on Amazon. He lives in Folsom, California with his wife and two boys where he enjoys being the second best-selling author in the house.

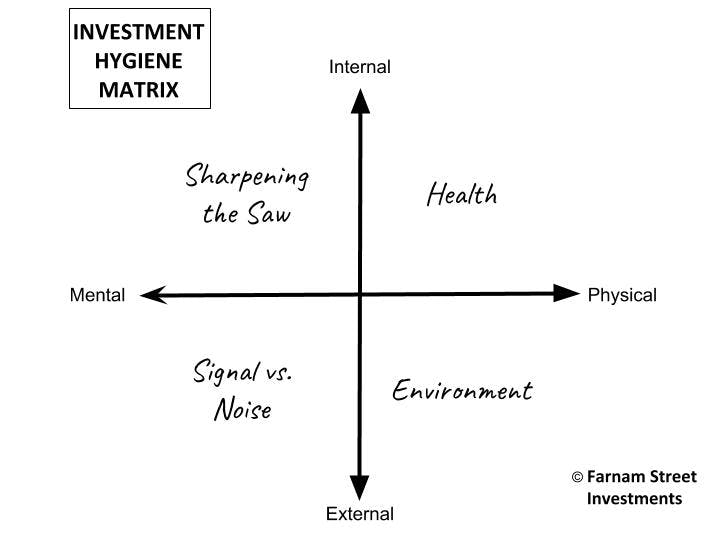

Written by Jacob Taylor

Table of Contents

1. The Day You Became a Better Investor

2. Internal + Physical = Health

3. External + Physical = Environment

4. Internal + Mental = Sharpening the Saw

1. The Day You Became a Better Investor

It’s a reasonably safe assumption that you bathe regularly and brush your teeth. You probably floss, comb your hair, and apply concoctions to make yourself smell good. Personal hygiene is evidently essential to humans; the U.S. cosmetics market generated $90 billion in revenue in 2018.

Yet there’s a type of hygiene that I bet you’re ignoring. Most people are.

There are numerous methods to prepare yourself for investment success. You can earn a CFA Level 3 or get your MBA. You can learn accounting, business models, Porter’s Five Forces, unit economics, and discounted cash flows. You can study market structures, Greek-letter-infused options, and historical booms and busts. You can learn about returns on capital, share buybacks, and reinvestment runways.

Don’t get me wrong, all of the above are the table stakes of investment competence.

But what if I told you there’s a whole world of considerations that even professional investors are neglecting? And what if you could turn this genre into your advantage over the pros?

I’m speaking specifically about your investment hygiene. It’s the habits, routines, and mindsets that make up your investment process. It’s all the stuff outside the 10Ks, earnings calls, and slide decks. The rest of this article will help you assess your investment hygiene, and set you on a path toward inevitable improvement.

For starters, we can split the hygiene universe into a matrix with four categories: internal vs. external, and mental vs. physical.

2. Internal + Physical = Health

Think about the last time you had a nasty cold. You probably felt tired, foggy-headed, and low energy. The last thing you wanted to do was put in a solid day’s work. Or even worse, can you imagine making a big decision when you were hiding from the world under your covers?

Let’s borrow Munger’s principle of inversion: imagine feeling the exact opposite of sick. Your body is coursing with vibrance and strength. You feel clear-headed and purposeful. You draw in a deep, confident breath and smile. You’ve got this and you know it.

Which of these physical states would you imagine giving you the best odds at making a sound decision? You already know the answer, yet when was the last time you checked for a peak state before placing a buy or sell order? Sadly, due to unexamined habits and a mismatch between our genes and our modern environments, it’s likely more of us exist toward the sick side of the spectrum. We’ve grown numb to our ailments. When you get yourself to full health, you realize it’s frankly an unfair advantage to be above that mental fog.

Researchers have found our physical state dramatically affects our decision-making. The wetware of our brains is based on electrical impulses and interacting chemistry. The balance of brain chemicals like serotonin, dopamine, oxytocin, and endorphins are radically altered by our sleep, diet, exertion, and stress. These chemical building blocks act as lenses through which we interpret the sensory data flow of our worlds.

Get the unfair advantage of health and make decisions with peak energy.

Even our posture impacts our chemistry. Researchers had people assume either a confident or submissive posture for just two minutes. In the confident posture group, testosterone levels increased by 20% and the stress hormone cortisol went down by 10%. Conversely, after the submissive pose, testosterone went down by 25% and cortisol up by 15%. Your posture is affecting your interpretation of the world. Did you sit up a little in your chair after reading this?

Be aware of body language.

“All life is an experiment. The more experiments you make the better.”

— Ralph Waldo Emerson

I’m hesitant to offer any definitive health prescriptions—everyone has opinions and we’re all different. What will work is unique to you, so my suggestion is to experiment until you find what makes you feel fantastic.

Charlie Munger gave us some hint at what not-to-do when he said, “Three things ruin people: drugs, liquor, and leverage.” (I would posit that we can substitute “stress” for “leverage” in this instance.)

Find what works for you so you feel fantastic.

3. External + Physical = Environment

In the previous section, we explored how we can control what’s going on inside our bodies to give us a chance at peak decision-making and investment results. Now let’s look outside. Literally.

Existing within four walls is a new phenomenon for our species. The U.S. EPA estimates Americans spend 93% of their time inside. Yet your distant ancestors spent most of their time outside. And they walked. A lot. Current estimates are they covered between 6 to 16 km (4 to 10 miles) per day to make their ancient livings.

It’s little wonder great minds throughout history from Aristotle to Einstein to Steve Jobs credited long walks for their creativity. The famed mathematician, Andrew Wiles, proved Fermat’s last theorem in 1995. He solved a fiendishly difficult math riddle which had stumped literal geniuses for more than 350 years. His advice is to get outside, but don’t forget your pencil: “When I’m walking I find I can concentrate my mind on one very particular aspect of a problem, focusing on it completely. I’d always have a pencil and paper ready, so if I had an idea I could sit down at a bench and start scribbling away.”

The Japanese have a practice called shinrin-yoku which translates into “forest bathing.” A 2016 study found forest bathing “significantly reduced pulse rate and significantly increased the score for vigor and decreased the scores for depression, fatigue, anxiety, and confusion.” Being in nature is the rough antithesis of social media. Make sure you defrag your mental hard drive with plenty of time in the verdant outdoors.

Get outside and walk, preferably in nature.

Your work space deserves thoughtful environmental design. Winston Churchill wisely observed, “We shape our buildings and afterwards our buildings shape us. ”You can tinker to find what works for you, but I personally like a lot of natural light and quiet background music when I’m doing heads down deep work. My office is also overstuffed with Warren Buffett and Berkshire paraphernalia. It serves as a constant reminder to imagine myself in my hero’s shoes. #WWWD

Thoughtfully design your environment.

In 1729, French astronomer Jean-Jacques de Mairan made a wild discovery. He noticed that the leaves of plants opened in the morning to catch sunlight and closed at twilight to protect themselves overnight. Seems like an obvious adaptation, but here’s where it gets interesting. The plants did this same opening and closing routine, even when hidden in total darkness inside his cabinet. It wasn’t the light that triggered the plant’s actions. The implication was that a humble house plant has a built-in clock. Cool!

Humans are equally equipped. Our clock sits inside our hypothalamus and is called the suprachiasmatic nucleus. It’s a cluster of 20,000 cells–the size of a grain of rice. Our internal clock regulates hormones, changes our body temperature, and helps us fall asleep and wake up over a 24-hour cycle.

Your clock affects more than just how you feel. It affects your performance. Researchers found that time-of-day effects can explain 20 percent of the variation in human output. “The performance change between the daily high point and daily low point can be equivalent to the effect on performance of drinking the legal limit of alcohol,” says neuroscientist Russell Foster. You may be “drunk-working” right now depending on the time of day you’re reading this.

Our chronotypes change as we age, showing up as cliches: young kids tend to wake up at ungodly early hours, teenagers stay up all night and can’t do anything before lunch, and the elderly are up before the sun and ready for dinner at 4pm, Matlock at 6pm, and bed at 7pm.

It’s not just about energy or feeling mentally sharp. Vigilance is a more apt description. At our peak, our vigilance is highest. This limited reserve helps our brains solve analytical problems and block out distractions. We stay vigilant to the task at hand rather than bouncing around inside our scattered minds.

Depending on the task, vigilance can be an unwanted hindrance. An unconstrained mind is the ticket to outside-the-box thinking. We need a soft and diffuse gaze, not laser focus. Insights usually come when we’re distracted, with fewer inhibitions and less vigilance. #showerthoughts

Here’s our math wizard Andrew Wiles again:

“Leading up to that new idea there has to be a long period of tremendous focus on the problem without any distractions. You have to really think about nothing but that problem–just concentrate on it. Then you stop. Afterwards there seems to be a kind of period of relaxation during which the subconscious appears to take over, and it’s during that time that some new insight comes.”

Each of us has a physiological chronotype which creates our own personal daily pattern of peak (alert, high energy, high vigilance), trough (tired, slow, easily distracted), and rebound (renewed energy, but limited vigilance).

About 75% of us who are early risers and middle-packers follow this archetypal peak-trough-rebound pattern. The remaining 25% are night owls and follow a different pattern: rebound-trough-peak.

To figure out your chronotype, you can use Daniel Pink’s handy questionnaire: http://www.danpink.com/MCTQ

The most important thing you can do is protect your peak. Save your highest-leverage, heads-down work for when you have your fullest reserve of vigilance. Don’t fritter it away with administrative or mundane tasks.

Be aware of when you work.

I’m a fan of the “Pomodoro Method.” Set a timer for twenty minutes, close the distraction of email, social media, and a thousand browser tabs, and focus on your most important task. When the timer goes off, take a guilt-free break. Get some water, stretch a little, close your eyes and let your brain drift into neutral. After five minutes of letting go, set the timer and get back to the grindstone. After three or four cycles, reward yourself with a walk outside. Don’t be surprised if inspiration strikes when you’re out there. You’ll be amazed at what you can accomplish within these structured cycles.

Set a timer.

4. Internal + Mental = Sharpening the Saw

Mental errors are born from our blindspots. We make mistakes when we miss something important. One way to make sure you don’t make the same investment mistake twice is to use a checklist. Every slip-up becomes a new checklist item for the next evaluation. If you’re really smart like Mohnish Pabrai, you’ll catalog the mistakes of others and learn vicariously through their painful losses. There are simply too many different permutations of investment mistakes and mental models to keep straight in your head. Get them into a checklist and out of the working RAM in your brain.

Checklists have been used to great effect in other industries like airlines and medicine where real lives are at stake. A well-crafted checklist adapts to your investment style over time and is the quickest path to improving your process. The sooner you start failing and cataloging, the sooner you’ll get good.

Use an investment checklist.

Researcher Robin Hogarth divides the world into kind and wicked learning environments. Kind learning environments link feedback directly to the appropriate actions or judgments and are both accurate and plentiful. Think about riding a bike: you learn quickly (and painfully) when you make a mistake. There’s no ambiguity in crashing and skinning your knee.

In wicked domains, feedback from your actions and decisions is poor, misleading, or even missing. The investment world is about as wicked as it gets. You can be right on your analysis and something unforeseen (like say, a global pandemic) produces an awful result. Perhaps even worse, you could conduct shoddy analysis and yet watch your stock rocket higher for reasons you’ll invent after the fact. People are at their most dangerous after dumb-luck smiles upon them. Perhaps unsurprising, separating luck versus skill in the investment world is fiendishly difficult. Fortunately, a weatherman of all people has the answer.

In 1950, a statistician-turned-meterologist named Glenn Brier developed a simple methodology for scoring predictions. The score is based on two factors: the probability assigned to a particular future outcome, and whether it actually happened. Combining these two is called a Brier Score in his honor. It relays the accuracy of your predictions, as well as a calibration of your confidence about the prediction. Check this out for a fun calibration test of your own confidence versus accuracy.

Determining if you are a good investor (or not) can take literally a decade or longer if you’re only observing annual returns. We need to measure ourselves in a different way to speed up the process. One smart hack is to make predictions about the companies you’re interested in and then track the accuracy and your confidence. For instance, you could record that you think there’s a 70% chance that $AAPL’s earnings will be 10% higher in 12 months. You’ll know in a year if that turned out to be true or not, independent of where the stock goes. You could make five similar predictions about a company’s fundamentals for every one return data point you get in a given year. This can shrink the decade-plus evaluation period considerably, and give you a sense of your own luck versus skill.

Brier scores are the missing element to close the feedback loop and tame the wicked investing environment into submission.

Next Issue: Part 2. Calibration.