Writing from My Favorite Investors

Matthew Peterson’s 13F Practice

This is the fourth in a series of pieces written by guest investors reflecting on their practices. In this one, I asked Matthew Peterson to reflect on how exactly – logistically – he knows his edge and keeps it. I find this is something so many investors talk about it, but few actually practice regularly; Matthew does, and in this issue he’s sharing the details with us.

Matthew Peterson is the Managing Partner of Peterson Capital Management, which he founded in 2011. He’s been a financial professional for two decades, is a Chartered Financial Analyst, and has worked with Goldman Sachs, Morgan Stanley, Merrill Lynch, American Express, and Ameriprise Financial.

Written by Matthew Peterson

Table of Contents

1. Know Your Edge

2. Find That Edge

3. Process

1. Know Your Edge

Danielle has asked me to share some comments on best practices pertaining to our initial investment philosophy and process. It is a pleasure to provide my contributions to this newsletter.

The ease in which one can participate in investment markets leads some highly intelligent folks who have experienced financial success to mistakenly believe it is easy to outperform the market, institutions, and professional experts. But it’s not as easy as it looks. This is an extremely competitive arena, so you must know your edge.

It is essential to have a channel or multiple channels that present the very best investment opportunities for your research. Screening for good financial metrics on any number of websites is the wrong starting point because so many other people are doing this and you have no advantage. We recognized many years ago that a screening filter for “cheap” firms with appealing ratios has become much less effective because of the ease and widespread use of this practice.

Common screens, such as low enterprise value (EV) to EBITDA, high return-on-equity (ROE), or increasing profit margins, may narrow the search but do not always result in a cheap pool of (quality) securities. This common approach to eliminate expensive securities introduces what statisticians classify as type I errors (incorrect rejection) and type II errors (incorrect inclusion). Many cheap stocks are overlooked (type I error) and other stocks that screen cheap are priced that way for a reason (type II error).

With our current portfolio fully allocated to long term compounders, we need very few new ideas to be successful. Fortunately, we do have some alpha producing hacks that help us focus on the right firms, while reducing error rates.

Our objective when we need a new place for capital is to uncover an opportunity so deeply undervalued with so much untapped potential that it is more attractive than anything we already own. If it is not superior, we would gladly add to something we already own. To find a security this rare, and with roughly 10,000 opportunities at our disposal, we must narrow the scope of securities, otherwise it will require luck to stumble across a single desired stock that’s selling for below its intrinsic value.

2. Find That Edge

Fortunately, there is an alpha producing hack that anyone can utilize. Our search begins by reviewing the 13F reports available on the SEC website that display the portfolios of the great long-term value investors. We study the businesses they own meticulously.

Value investors build positions over quarters and years and might hold a single position for a decade or longer. Every 90 days, the SEC requires institutional investors with $100 million or more under management to file a 13F report disclosing each U.S. holding. A detailed quarterly analysis might include the analysis of 100 global investors to narrow tens of thousands of potential opportunities to the few hundred that are actively acquired by top funds.

In this highly competitive industry, applying this initial filter allows us to fish in the right investment pool. Charlie Munger has reminded us to “fish where the fish are” and if you are looking through 13F reports of 100 great value funds, you will naturally be encountering some whales.

Many known value investors hold very concentrated portfolios, so a new position may constitute 10% or more of a multibillion-dollar portfolio. They may have spent enormous monetary sums and thousands of employee hours scrutinizing the business, competition, moats and every other facet before determining its attractiveness. This intelligent filter provides hundreds of different securities to research and select from, but it is a much better starting place than a typical stock screen.

Firms on our list evolve slowly and below are some common 13F examples that alone would provide plenty of good research opportunities:

- Berkshire Hathaway (Buffett) – SEC, Dataroma

- Fairfax (Watsa) – SEC, Dataroma

- Aquamarine (Spier) – SEC, Dataroma

- Pabrai Funds (Pabrai) – SEC, Dataroma

- Baupost (Klarman) – SEC, Dataroma

- Ancient Art Teton (Lee) – SEC, Fintel (no Dataroma listing)

- Third Point (Loeb) – SEC, Dataroma

- Pershing Square (Ackman) – SEC, Dataroma

- Greenlight (Einhorn) – SEC, Dataroma

(Note from Danielle: To ease your practice, I’ve added links above to each of the 13Fs, and included an extra link to Dataroma because it gives an easy quick snapshot of their holdings.)

3. Process

The physical process we employ is quite simple. Over years, we have developed proprietary spreadsheets that filter and format position changes and summarize each portfolio on our 13F watchlist. Following this method allows us to quickly determine a couple hundred interesting firms worthy of our time for deeper analysis.

This data is easily obtainable on the SEC website. We simply open two browsers for a firm, analyze two consecutive reports and note any position updates in the spreadsheet.

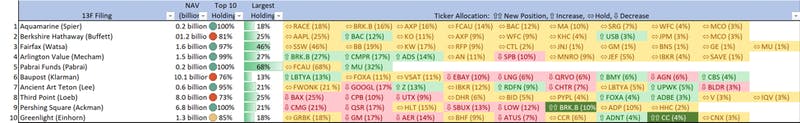

This allows updates to dozens of funds over a few hours and acts as a research guide. Below are some examples from a 2019 report.

To further narrow this list, we immediately remove known firms that are not of interest and discard anything not clearly within our circle of competence. With several dozen firms at hand, the real research can now begin.

We are searching for compounders with excellent business models, high quality management, available for a great price. These types of businesses will grow for decades so we require very few new positions. Thus, 13F results from any given quarter are unlikely to become new positions in our portfolio. Still, this pre-research process is an important tool that focuses our attention on firms likely to be especially successful.

(Note from Danielle: It’s such absolute gold to get to see an actual spreadsheet for tracking 13Fs. Since talking with Matthew about his process when he was writing this piece for us, I’ve started my own tracking spreadsheet – ‘started’ being the key word, because I’m no Excel expert and it takes me a long time to create a functioning spreadsheet, but I’m excited for its possibilities as it becomes a better tracker with time. Matthew says the real key with 13Fs is to find balance: stay up on them quarterly in case something pops out at you, but not spend too much time sifting through them. As always, remember the huge caveat that 13F filings probably don’t represent an investor’s entire portfolio and don’t include any stocks they’ve sold short.)